Would you like to know where you can obtain a bike loan without a down payment? It is possible to get a bike loan without making a down payment. You can now finance a bike with zero down payment from various banks and non-banking financial institutions.

Two-wheeler loans in the past used to charge interest rates as high as 15 to 30% of the bike’s MSRP. With an additional processing fee on top of that. However, those days are gone. Your preferred lender will now cover up to 100% of the MSRP of your bike with a zero down payment bike loan. The processing fee is all you have to pay, nothing more!

A paperless zero down payment bike loan is now available from most lenders. As a result, the loan application is approved within one business day. It’s never been easier to buy the bike of your dreams! For more information, contact the loan spokesperson today.

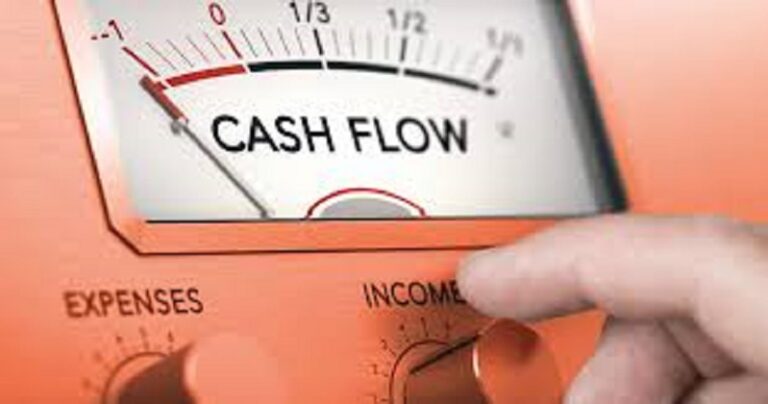

Why is zero down payment better?

Financial stress could prevent you from paying the entire amount for a bike upfront in certain situations. Getting a loan equal to the entire amount, i.e., the bike’s price, is possible if you have trouble paying the down payment. In this case, there is no down payment required. Whether you are self-employed or salaried, you are eligible for this loan.

You would have to wait a few hours or days for a financial institution to approve your bike loan. Financial institutions check your CIBIL scores, credit scores, and credit reports to disburse your bike loan.

The loan officer is responsible for seeking approval from the financial institution once the documents are forwarded. With the online zero down payment bike loan application, applicants can receive instant loans, get quick processing, pay a minimal interest rate, and pay the loan off over a longer tenor.

If you do not have a stable source of income, you might not be easily approved for a two-wheeler loan. At least two years in the same business are required for self-employed individuals. The lender may deny your application if there are breaks in the business. If a zero-down payment is required for a bike loan, the lender may charge some processing fees and other fees, but the total bike price would be financed.

There is no down payment required for a bike loan. Zero down payment bike loan option is offered by some NBFCs, such as Bajaj Finserv, which extends the loan up to the total on-road bike price as the loan amount. However, registration and other associated fees will have to be paid from your pocket. A loan amount will be determined by the amount of income you earn compared to your financial commitments and expenses.

The location of your residence plays a critical role in the approval of bike loans. Some lenders may require you to be a resident of the city where you are applying for a loan on two-wheelers for at least one year.

Here’s the tricky part: bike loans are charged interest based on some factors, including:

- Lenders’ policies

- Based on the lender’s criteria, your eligibility and profile are evaluated.

- The CIBIL score you have

- A bike loan’s tenor,

- Bikes you are interested in purchasing

- The location of your business

- Relationships you had with the lender in the past.

For an estimate of your eligible interest rate, contact a customer service representative instead of trying to figure it out yourself. Applicants for two-wheeler loans must provide proof of their age, residence, and income for the lending institution to approve them.

The lending institution must determine your eligibility and handle the two-wheeler loan application based on your information. The institution will send you a confirmation letter after confirming your loan. After completing the loan agreement, your cash may be available for withdrawing within 5-7 business days.

You can borrow up to Rs.2.5 lakh on a personal loan in India, and the interest rate is between 10-15%. In case you have an approval letter from HDFC Bank, then you can fill up the form on their website and apply for a HDFC Personal loan .

Go to Home Page